Lawmakers are once again trying to make housing more affordable and ease the property tax burden for Kansas homeowners.

Takeaways

- Property taxes are primarily collected on the local level, making state-level reforms tricky.

- Democrats pitched a host of reforms that may not pass a Republican-controlled statehouse.

- Lawmakers have promised property tax relief before, but homeowners want more.

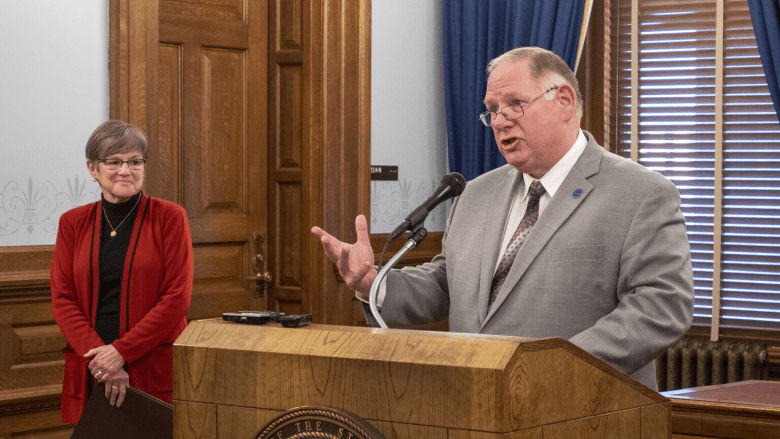

“This is probably one of the biggest things that we hear as we go across the state,” said Speaker of the House Dan Hawkins, a Wichita Republican. “People really hate property tax.”

Both parties have released their policy agendas for the 2026 legislative session. The session started Jan. 12, and both parties want to address housing costs. Republicans are still crafting property tax proposals while Democrats have a more detailed plan for housing affordability.

A majority of Kansas property taxes are collected at the county and city levels. The state used to collect 21.5 mills in property tax. Of that, 1.5 mills were for education building construction and maintenance and the rest funded school operations.

Lawmakers cut the 1.5 mills for maintenance.

The 1.5-mill cut only meant homeowners saved $25 on a $150,000 home. Homeowners are asking for more relief, but larger cuts hurt school funding.

“We have to be careful what we do,” Hawkins said. “We can’t mess it up. We can’t do something that’s going to cause us problems later on as a state.”

Hawkins was asked about major overhauls, like Florida’s attempt to completely remove property tax. But he said that isn’t something Kansas will do.

This is the third consecutive year lawmakers will be highly focused on property taxes.

In 2024, lawmakers passed a $1.2 billion tax cut that reduced income taxes and taxes on Social Security benefits. Lawmakers in 2024 said it lacked enough property tax relief and vowed to address the issue in 2025.

In 2025, a Kansas constitutional amendment that would cap property valuation increases at 4% gained some traction. Property taxes could still rise more than 4%, but the assessed value of a home could not.

That plan barely passed the Senate before dying in the House. Another proposal would have created a state fund that paid money directly to local municipalities if they kept property taxes low. But that plan also didn’t advance.

“I assure you that you will see this year,” Hawkins said, “the Senate and the House working together to try to find a solution that the state can at least bring to bear.”

Democrats have pitched expanded exemptions for all sorts of homeowners.

Right now, the first $75,000 of a home’s value isn’t taxed. Democrats want to increase that to $125,000. They’re also pushing for tax rebates for renters that would allow renters to “get up to 15% of their rent back.” Another housing affordability proposal would increase the exemption in the senior property tax freeze program to $500,000 in property value and increase the income cap to $75,000.

They also want to limit how many homes certain corporations can own and cap how much landlords can charge renters in late fees. It isn’t clear if these proposals will pass a Republican-dominated legislature.

Republicans have a supermajority in both chambers, which means they can pass proposals without Democratic support if every lawmaker votes on party lines. But Democrats said outlining these proposals is important because Kansans support them, even if Republicans don’t.

Rep. Rui Xu, a Westwood Democrat, said this isn’t about going after landlords or taking rentals off the market. He said housing prices skyrocket when homes are treated like financial assets.

“When Kansans talk about housing, what they’re really talking about is affordability,” Xu said. “Whether they can stay in their home this month, or whether they’ll be able to afford one of their own.”